Micropayments, microbilling, microtransactions, call it what you will; it is one of those ideas people say they want but actually do not. In particular, micropayments are not a viable replacement for the broken advertising model for the web.

Every once in a while somebody opines that the way to fix the web is by implementing micropayments. Today’s example comes from Charlie Stross:

THOUGHT FOR THE DAY: Search algorithms on the ad-funded web are all about selling you something you don't need or want. Marketing in the purest sense. When the W3C opted for ad-supported web rather than microbilling to fund build-out of the internet to the general public back in 1996 they made a terrible mistake: in the 30 year time scale it may turn out to have cost us democracy.

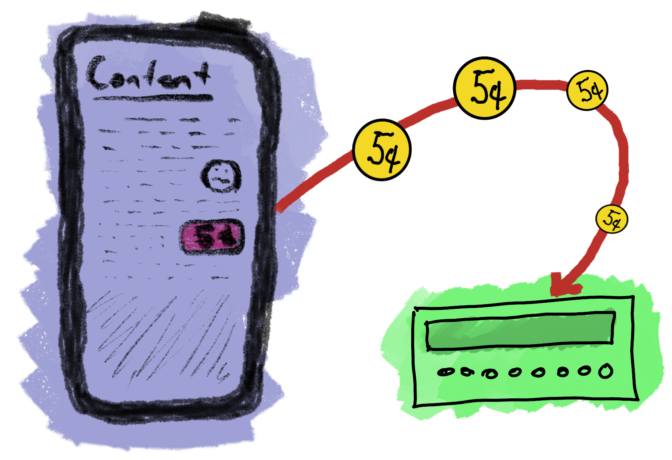

Stross is right that targeted advertising is a cancer, riddling everything it touches with data-collecting tumorware. Micropayments are a simple idea - instead of having to rely on advertising, a site could charge a tiny fee (5 cents, 1 cent, or even quarter of a cent) for access. Popular sites could rake in millions per month (even sheep.horse could make a couple of bucks) and readers wouldn’t even notice such a small charge.

The consumer gets a ad free experience for a trivial fee. The publisher gets paid directly without having to sully their content with ads. And the hypothetical payment processor takes a small cut of millions of tiny transactions. A win-win-win on the surface that all three groups have often wished for.

But is it really? Lets investigate further.

First lets take the biggest hurdle : nobody actually wants to implement and run micropayment infrastructure. That last sentence is not quite true, its been tried many times but not by the people that actually matter - the card networks that actually handle transactions.

Transactions seem like a simple thing - subtract an amount from one account and add it to another. If that was all it took then a single server could handle every credit card in the world but instead each transaction requires checking the source and destination against various lists to prevent fraud, the application of various taxes, collating similar transaction to detect suspicious behavior, and finally subtracting the network’s cut.

Of course, much of this does not directly benefit either the buyer or the seller so maybe we could get away with not implementing the fraud protection. Unfortunately not. Any payment system (micro or otherwise) is going to immediately be used for fraud, do not think micropayment’s small stakes make fraud unworkable. Advertising deals with even lower dollar amounts and fraud is rampant. And fraud can be automated - those quarter of a cents really add up if you have a botnet to call on.

And we haven’t even talked about chargebacks yet. Do micropayment proponents really think that people won’t ask for refunds on 10 cents worth of article when they decide they don’t agree with it? Chargebacks are the reason people trust credit cards - any payment system will have to support them to prevent publishers from just not delivering the promised content.

All this adds complexity and cost to a payment network. There is a fixed floor per transaction that will swamp the value of any transaction under a few cents. It is not for no reason that in systems that come closest to micropayments (Apple's app store, Patreon, etc), the lowest value items are typically around one dollarAnd the expensive credit card transactions are coalesced into higher values, which suits everyone..

It simply isn’t worth dealing with values less than that.

What about the consumers? Are they really clamoring for pay money for access to the web? Probably not just due to user friction because you would certainly want at least a confirmation box that a payment was being made on your behalf. Otherwise a site could silently charge you hundreds of times. Apple Pay gets this right for a security view - you need to use your fingerprint to confirm each transaction, but who wants to use Apple Pay a dozen times a hour while surfing?

Even if the experience was frictionless, history has shown that consumers will flock to a free service no matter how ad-infested. A pay-per-access Facebook or Twitter would never gain popularity (it has also been tried.)

And it is not like payments don’t come with their own problems with data collection. If you are going to implement chargebacks and collect taxes you are going to need to collect data on each transaction. Data that uniquely identifies a payer and payee and what they paid for. Instead of preventing the data collection that advertising feeds on, micropayments centralize the collection of even more valuable data.

Do you really think a payment processor will not sell information about of who you paid?

There are some that claim that cryptocurrency solves these problems. It has been tried and it does notIt is my opinion that cryptocurrency doesn't really solve any problem particularly well..

Any cryptocurrency that is properly decentralized is too expensive in terms of transaction fees to make anything like a micropayment feasible. And if they are properly anonymous then chargebacks don’t exist and fraud will swamp legitimate uses.

I could go on. Piracy of content (site cloning) would become a bigger problem. Services like the wayback machine would not exist for articles behind even the lowest of paywall. Even search engines would become much less workable.

All these reasons pale in comparison with the the single biggest problem with micropayments as a replacement for advertising, which is that publishers would simply implement both. Even if a site offered an ad-free micropayment tier of content they would still run the data collecting part of the adware. They would be even more incentivized to collect because there is no data more valuable than data from a paying customer.

If you still disagree with the premise of this article consider this; you just read 900 words of my content. If I was sitting beside you, exactly how motivated would you feel to pull out your wallet and give me 10 cents?